Under the accrual method of accounting, expenses are to be reported in the accounting period in which they best match the related revenues. If that is not clear, then the expenses should be reported in the period in which they are used up. If there is uncertainty as to when an expense is matched or is used up, the amount spent should be reported as an expense in the current period. Program expenses (or program services expenses) are the amounts directly incurred by the nonprofit in carrying out its programs. For instance, if a nonprofit has three main programs, then each of the three programs will be listed along with each program’s expenses. Additionally, the line items in your organization’s statement of activities should match those in the operating budget you created at the beginning of the fiscal year.

What does a Statement of Activities Include?

If you don’t keep up with the latest rules for recognizing revenue, you may report your organization’s income wrong on your Statement of Activities. Often, this leads to large audit adjustments, budget vs actual reporting difficulties, and other funding challenges. As a CPA working with statement of activities nonprofit example nonprofits of all sizes, I’ve encountered numerous errors in Board of Directors’ financial reports and Statements of Activities documents. Being aware of these common pitfalls is crucial for maintaining the integrity of your financial reporting and in turn, the trust of your supporters.

Need your Statement of Activities on time, every month?

- As we mentioned earlier, many nonprofits use these financial statements in their annual reports to show transparency and build trust in their organization.

- This section of the Statement of Activities plays a crucial role in how the organization is perceived by external parties and how it manages its internal operations to maximize impact on its mission.

- This practice should highlight variations in income and expenditures, prompting investigation and action when necessary.

- For financial leaders in not-for-profit organizations, establishing standard procedures for maintaining an accurate Statement of Activities is not just best practice—it’s a necessity.

- Get our FREE GUIDE to nonprofit financial reports, featuring illustrations, annotations, and insights to help you better understand your organization’s finances.

For financial leaders in not-for-profit organizations, establishing standard procedures for maintaining an accurate Statement of Activities is not just best practice—it’s a necessity. These procedures are the backbone of transparent and reliable financial reporting, crucial for operational excellence and strategic decision-making. A statement of activities and an income statement are essentially the same thing, with the main difference being the terminology used for different types of organizations. Organize the information into a statement of activities, which typically includes multiple columns to report the amounts for each category, such as without donor restrictions, with donor restrictions, and total. The other thing that FASB 117 requires of nonprofit entities is reporting of expenses by functional classification. This means that a nonprofit statement of activities should have at least two categories.

Join the fundraising movement!

This section highlights the difference between total revenues and total expenses, indicating whether the organization has a surplus or deficit for the period. It also reflects any adjustments due to gains or losses on investments, grants, or other financial activities. This information is crucial for assessing the nonprofit’s financial sustainability and its ability to continue fulfilling its mission in the long term. Nonprofit organizations play a crucial role in addressing societal needs, often relying on donations and grants to fund their missions. Unlike for-profit entities, nonprofits must adhere to specific accounting standards that ensure transparency and accountability to donors, grantors, and regulatory bodies. By analyzing your nonprofit’s statement of activities, your organization can determine if the expenditures currently allocated for each of your programs are sustainable for the long run.

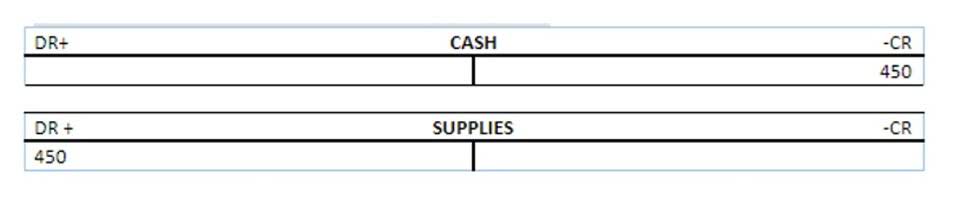

Nonprofits can use this report to file Form 990 with the IRS and provide donors with transparency and trust in the organization. For example, a management employee might be spending 30% of her time in fundraising activities but her entire salary has been recorded as management and general expenses. Under the accrual method of accounting, revenues are reported in the accounting period in which they are earned. In other words, revenues might be earned in an accounting period that is different from the period in which the cash is received.

- Code for Science & Society depicts their financial expenses on this page of their report rather concisely and transparently.

- Foundations require nonprofits to provide financial statements when they apply for grants.

- This includes things such as your non-profit’s bank statements, tax returns, and investment statements.

- This article is for informational purposes only and should not be considered financial advice.

- The Statement of Activities in nonprofit accounting is akin to an income statement used in for-profit businesses, but with some key distinctions that reflect the unique goals and structure of nonprofits.

Additional Resources

Get our FREE guide to nonprofit financial reports, featuring illustrations, annotations, and insights to help you better understand your organization’s finances. Get our FREE GUIDE to nonprofit financial reports, featuring illustrations, annotations, and insights to help you better understand your organization’s finances. You can use unrestricted funds for any mission-oriented purpose, including paying general operating expenses and salaries.